Loan app providers are fintech companies that offer a convenient and efficient way for individuals and businesses to apply for and manage loans through mobile apps. They offer a variety of loan options, competitive interest rates and terms, and use advanced technology to assess creditworthiness. However, borrowers should carefully review terms and compare offers from multiple providers to find the best loan for their needs.

1. “Paytm Loans”

This app, which is part of the popular Indian digital wallet and e-commerce platform Paytm, offers a variety of loans, including personal, business, and home loans. Users can apply for a loan directly through the app and track their application status.

2. “Loanbaba”

This app offers personal, business, and home loans. Users can compare offers from multiple lenders, apply for a loan directly through the app, and track their application status.

3. “Money View Loans”

This app offers personal loans and business loans. Users can apply for a loan, track their application status, and access financial resources through the app.

4. “KreditBee”

This app specializes in personal loans and offers quick disbursals and easy eligibility criteria. Users can apply for a loan, track their application status, and access financial resources through the app

5. “InstaEMI”

This app offers personal, business, and home loans. Users can compare offers from multiple lenders, apply for a loan directly through the app, and track their application status.

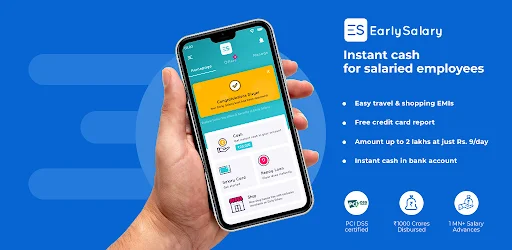

6. “EarlySalary”

This app offers personal, salary advance, and credit card loans. Users can apply for a loan, track their application status, and access financial resources through the app

7. “CASHe”

This app offers short-term personal loans, and users can apply for a loan, track their application status, and access financial resources through the app

8. “Home Capital”

This app offers home loans and loan against property. Users can apply for a loan, track their application status, and access financial resources through the app

9. “Fullerton India”

This app offers personal, business, and home loans. Users can apply for a loan, track their application status, and access financial resources through the app

10. “Capital Float”

This app offers business loans and working capital loans. Users can apply for a loan, track their application status, and access financial resources through the app

Overall, these apps provide a convenient and efficient way for Indian users to apply for and track loans. They offer a variety of loan options and resources to help users make informed decisions. It is important to compare different loan providers to find the best option for your specific needs and always read the terms and conditions carefully before applying for a loan.

จอ LED

thx for information PGSLOT

Good post! We will be linking to this particularly great post on our site. Keep up the great writing

bahis siteleri

Hi my family member I want to say that this post is awesome nice written and come with approximately all significant infos I would like to peer extra posts like this

I dugg some of you post as I cogitated they were very useful handy

Discover the best betting sites for a popular and profitable betting experience among reliable betting sites.

Забота о недвижимости – это забота о вашем комфорте. Тепловая обработка фасадов – это не только стильный внешний вид, но и обеспечение теплового комфорта в вашем уголке уюта. Мастера, наша команда профессионалов, предлагаем вам превратить ваш дом в идеальный уголок для проживания.

Наши творческие работы – это не просто утепление, это творчество с каждым кирпичом. Мы придерживаемся гармонии между внешним видом и практической ценностью, чтобы ваш уголок стал не только уютным и стильным, но и шикарным.

И самое главное – приемлемые расходы! Мы верим, что качественные услуги не должны быть неприемлемо дорогими. [url=https://ppu-prof.ru/]Стоимость утепления дома снаружи цена[/url] начинается всего начиная с 1250 руб/м².

Современные технологии и высококачественные строительные материалы позволяют нам создавать термомодернизацию, которая гарантирует долгий срок службы и надежность. Прощайте холодным стенам и дополнительным тратам на отопление – наше утепление станет вашим надежным защитником от холода.

Подробнее на [url=https://ppu-prof.ru/]www.ppu-prof.ru[/url]

Не откладывайте на потом заботу о приятности в вашем доме. Обращайтесь к опытным мастерам, и ваш дом превратится настоящим художественным творчеством, которое принесет вам не только тепло. Вместе мы создадим жилище, в котором вам будет по-настоящему уютно!

bastan sona ta ta ta ananin amina kadar

thank you admin very nice post

What i do not realize is in fact how you are no longer actually much more wellfavored than you might be right now Youre very intelligent You recognize thus considerably in relation to this topic made me in my view believe it from numerous numerous angles Its like men and women are not fascinated until it is one thing to do with Lady gaga Your own stuffs excellent All the time handle it up

Excellent blog here Also your website loads up very fast What web host are you using Can I get your affiliate link to your host I wish my web site loaded up as quickly as yours lol

Just wish to say your article is as surprising The clearness in your post is just cool and i could assume youre an expert on this subject Fine with your permission allow me to grab your RSS feed to keep updated with forthcoming post Thanks a million and please keep up the enjoyable work

I couldn’t help but be enthralled with the basic information you offered about your visitors, so much so that I returned to your website to review and double-check recently published content.

thank you admin very nice blog

Hey, cool post You can check if there’s a problem with your website with Internet Explorer. Because of this issue, many readers will overlook your excellent writing because IE is still the most popular browser.

you are in reality a just right webmaster The site loading velocity is incredible It seems that you are doing any unique trick In addition The contents are masterwork you have performed a wonderful task on this topic

Esto puede ser molesto cuando sus relaciones se interrumpen y no se puede rastrear su teléfono. Ahora puede realizar esta actividad fácilmente con la ayuda de una aplicación espía. Estas aplicaciones de monitoreo son muy efectivas y confiables y pueden determinar si su esposa lo está engañando.

Deneme bonusu veren siteler boyle kahpe gormedi

Instalación simple y descarga gratuita, no se requieren conocimientos técnicos y no se requiere raíz.Grabacion de llamadas, Grabacion de entorno, Ubicaciones GPS, Mensajes Whatsapp y Facebook, Mensajes SMS y muchas características mas.

dhycy4

You can even sign up for a see-through version with Vegas Glass Kayaks.

89di49

This gateway is incredible. The splendid substance displays the administrator’s commitment. I’m overwhelmed and envision more such astonishing material.

j28h9w

This asset is unbelievable. The wonderful information exhibits the creator’s earnestness. I’m stunned and anticipate more such mind blowing posts.

lfb08a

Наша бригада опытных мастеров приготовлена предложить вам новаторские системы утепления, которые не только снабдят устойчивую покров от холодильности, но и подарят вашему дому оригинальный вид.

Мы работаем с современными компонентами, утверждая постоянный срок использования и выдающиеся результирующие показатели. Изоляция фасада – это не только экономия энергии на отоплении, но и забота о экологической обстановке. Энергосберегающие методы, какие мы применяем, способствуют не только своему, но и сохранению природных ресурсов.

Самое важное: [url=https://ppu-prof.ru/]Стоимость утепления стен снаружи[/url] у нас стартует всего от 1250 рублей за м2! Это доступное решение, которое переделает ваш хаус в реальный комфортный локал с минимальными затратами.

Наши пособия – это не только теплоизоляция, это образование площади, в где каждый элемент отразит ваш персональный образ. Мы возьмем во внимание все твои пожелания, чтобы воплотить ваш дом еще дополнительно уютным и привлекательным.

Подробнее на [url=https://ppu-prof.ru/]http://ppu-prof.ru/[/url]

Не откладывайте труды о своем доме на потом! Обращайтесь к исполнителям, и мы сделаем ваш домик не только уютнее, но и более элегантным. Заинтересовались? Подробнее о наших проектах вы можете узнать на официальном сайте. Добро пожаловать в универсум гармонии и качественной работы.

I should look at this webpage, as my brother advised, and he was entirely right. You have no idea how much time I spent looking for this information, but this post made my day.

mps5ht

ausd4g

Hi there, just became aware of your blog through Google,

and found that it’s truly informative. I am gonna watch out for brussels.

I will be grateful if you continue this in future.

Lots of people will be benefited from your writing. Cheers!

It’s going to be finish of mine day, but before ending I am reading this enormous post to improve my knowledge.

I used to be recommended this web site by my cousin. I’m no longer

positive whether this publish is written by means of him as nobody else realize such distinct about my

difficulty. You’re incredible! Thank you!

It’s an awesome paragraph in support of all

the internet people; they will take advantage from it I

am sure.

Do you have any video of that? I’d care to find out some additional information.

Today, I went to the beach front with my kids.

I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the shell to her ear and screamed.

There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is totally off topic but I

had to tell someone!

Thanks for finally writing about > Top 10 Loan Provider App in India : इन

ऐप्स के ज़रिए 10 मिनट में मिल जाता है

लोन < Liked it!

0a119y

1sq56j

9dvxew

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I loved as much as youll receive carried out right here The sketch is attractive your authored material stylish nonetheless you command get bought an nervousness over that you wish be delivering the following unwell unquestionably come more formerly again as exactly the same nearly a lot often inside case you shield this hike

Howdy! This is my 1st comment here so I just wanted to give a quick shout out and

tell you I genuinely enjoy reading through your posts.

Can you recommend any other blogs/websites/forums that deal with the same subjects?

Thank you!

Your article helped me a lot, is there any more related content? Thanks!

thebuzzerpodcast.com

Hongzhi 황제는 깜짝 놀랐고 약 그릇을 내려 놓고 귀를 기울여 들었습니다.

6idwx1

Thanks a lot for giving everyone an extraordinarily remarkable opportunity to read from this website. It’s usually very awesome and also packed with a lot of fun for me and my office peers to visit your blog the equivalent of 3 times in 7 days to learn the latest tips you have. Not to mention, I am always fulfilled concerning the outstanding inspiring ideas you serve. Some 1 facts in this posting are easily the most impressive I have ever had.

What Is Puravive? Puravive is a weight loss supplement that works to treat obesity by speeding up metabolism and fat-burning naturally.

child porn

What’s up colleagues, pleasant post and pleasant arguments commented at this place, I am truly enjoying by these.

jal39f

child porn

I like what you guys are up too. Such clever work and reporting! Keep up the excellent works guys I have incorporated you guys to my blogroll. I think it’ll improve the value of my website 🙂

I’m really enjoying the design and layout of your website. It’s a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did you hire out a designer to create your theme? Great work!

Nice post. I study one thing tougher on different blogs everyday. It’ll always be stimulating to learn content from different writers and follow a little bit one thing from their store. I’d prefer to use some with the content on my blog whether or not you don’t mind. Natually I’ll give you a link in your web blog. Thanks for sharing.

615g9m

It’s arduous to seek out knowledgeable individuals on this matter, however you sound like you know what you’re talking about! Thanks

9fywk9

zonnpy

I wish to point out my love for your kindness for those people who should have help with the idea. Your personal dedication to getting the solution throughout ended up being incredibly productive and have continuously helped most people like me to achieve their targets. The valuable help and advice can mean a great deal a person like me and a whole lot more to my peers. With thanks; from everyone of us.

Outstanding post, you have pointed out some good points, I as well conceive this s a very wonderful website.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

indian pharmacies safe https://indiaph24.store/# world pharmacy india

indian pharmacy paypal

medication from mexico pharmacy: Mexican Pharmacy Online – medicine in mexico pharmacies

hwc4ai

you’re in reality a just right webmaster. The website loading pace is amazing. It sort of feels that you are doing any unique trick. Furthermore, The contents are masterpiece. you have done a excellent process in this subject!

6jvmpj

I really appreciate this post. I have been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thx again!

zimzhb

Thank you a lot for giving everyone such a special possiblity to check tips from this web site. It really is so beneficial and as well , stuffed with a great time for me personally and my office mates to visit your web site nearly thrice per week to read the latest secrets you have got. Of course, I’m usually amazed for the powerful techniques served by you. Some two tips in this posting are really the most effective I’ve ever had.

uq8g2c

FitSpresso is a weight loss supplement developed using clinically proven ingredients extracted from natural sources.

Really Appreciate this post, is there any way I can receive an email when you write a fresh update?

Great remarkable things here. I am very glad to look your article. Thanks a lot and i’m taking a look forward to touch you. Will you please drop me a e-mail?

k496gk

Thanks for a marvelous posting! I certainly enjoyed reading it, you could be a great author.I will make certain to bookmark your blog and will come back sometime soon. I want to encourage you to definitely continue your great job, have a nice afternoon!

SightCare is a vision enhancement aid made of eleven carefully curated science-backed supplements to provide overall vision wellness.

2g46fm

I’ve been absent for a while, but now I remember why I used to love this website. Thanks , I¦ll try and check back more often. How frequently you update your website?

I discovered your blog site on google and test just a few of your early posts. Proceed to maintain up the superb operate. I just extra up your RSS feed to my MSN News Reader. Seeking ahead to studying more from you later on!…

Very interesting info !Perfect just what I was searching for!

I¦ll immediately take hold of your rss as I can’t find your e-mail subscription hyperlink or newsletter service. Do you’ve any? Kindly allow me understand so that I may subscribe. Thanks.

Hi my loved one I wish to say that this post is amazing nice written and include approximately all vital infos Id like to peer more posts like this

xw7j4f

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You clearly know what youre talking about, why throw away your intelligence on just posting videos to your blog when you could be giving us something informative to read?

Thank you a bunch for sharing this with all folks you really know what you’re talking approximately! Bookmarked. Please additionally discuss with my site =). We may have a link exchange contract between us!

I have been reading out many of your stories and i must say nice stuff. I will surely bookmark your blog.

Some really superb content on this site, thanks for contribution. “Once, power was considered a masculine attribute. In fact, power has no sex.” by Katharine Graham.

Fantastic beat I would like to apprentice while you amend your web site how could i subscribe for a blog site The account helped me a acceptable deal I had been a little bit acquainted of this your broadcast offered bright clear concept

It?¦s truly a nice and useful piece of information. I?¦m glad that you simply shared this useful info with us. Please keep us informed like this. Thanks for sharing.

Fantastic site A lot of helpful info here Im sending it to some buddies ans additionally sharing in delicious And naturally thanks on your sweat

Keep up the wonderful piece of work, I read few posts on this internet site and I think that your web site is really interesting and has bands of superb information.

Hey, you used to write magnificent, but the last several posts have been kinda boring?K I miss your tremendous writings. Past several posts are just a little out of track! come on!

certainly like your website but you need to take a look at the spelling on quite a few of your posts. Many of them are rife with spelling problems and I find it very troublesome to inform the reality nevertheless I will definitely come back again.

It is appropriate time to make some plans for the future and it’s time to be happy. I have read this post and if I could I want to suggest you some interesting things or advice. Perhaps you can write next articles referring to this article. I want to read more things about it!

Its such as you learn my thoughts! You appear to understand a lot approximately this, such as you wrote the guide in it or something. I feel that you could do with some percent to force the message home a bit, however instead of that, this is fantastic blog. A fantastic read. I will certainly be back.

78848z

I know this if off topic but I’m looking into starting my own blog and was curious what all is needed to get setup? I’m assuming having a blog like yours would cost a pretty penny? I’m not very web savvy so I’m not 100 certain. Any recommendations or advice would be greatly appreciated. Thanks

I am not sure where you are getting your information, but good topic. I needs to spend some time learning much more or understanding more. Thanks for magnificent info I was looking for this information for my mission.

WooCommerce SEO consulting

hi!,I like your writing so much! share we communicate more about your article on AOL? I need a specialist on this area to solve my problem. Maybe that’s you! Looking forward to see you.

This web site is really a walk-through for all of the info you wanted about this and didn’t know who to ask. Glimpse here, and you’ll definitely discover it.

Hey There. I found your weblog the use of msn. That is a very neatly written article. I will be sure to bookmark it and return to read more of your helpful info. Thanks for the post. I will certainly return.

Thank you for the good writeup It in fact was a amusement account it Look advanced to far added agreeable from you However how could we communicate

Good info. Lucky me I reach on your website by accident, I bookmarked it.

FitSpresso: An Outline FitSpresso is a weight management formula made using five herbal ingredients.

I like this post, enjoyed this one thank you for posting. “To the dull mind all nature is leaden. To the illumined mind the whole world sparkles with light.” by Ralph Waldo Emerson.

You have observed very interesting points! ps decent site.

I just wanted to express my gratitude for the valuable insights you provide through your blog. Your expertise shines through in every word, and I’m grateful for the opportunity to learn from you.

Hello! I know this is kind of off topic but I was wondering which blog platform are you using for this website? I’m getting fed up of WordPress because I’ve had issues with hackers and I’m looking at alternatives for another platform. I would be great if you could point me in the direction of a good platform.

Heya i am for the first time here. I found this board and I find It truly useful & it helped me out much. I’m hoping to give one thing back and aid others such as you helped me.

I’m not positive where you’re getting your information, however good topic. I needs to spend some time studying much more or working out more. Thanks for magnificent information I used to be searching for this information for my mission.

Awsome article and straight to the point. I am not sure if this is in fact the best place to ask but do you guys have any thoughts on where to employ some professional writers? Thx 🙂

Hi, Neat post. There’s a problem with your web site in web explorer, may test

this? IE nonetheless is the market chief and a good section of other folks will leave out your fantastic writing due to this

problem.

First of all I want to say terrific blog! I had a

quick question in which I’d like to ask if you don’t mind.

I was interested to know how you center yourself and clear your head

before writing. I’ve had a hard time clearing my thoughts in getting my

ideas out. I do take pleasure in writing but it

just seems like the first 10 to 15 minutes tend to be lost

just trying to figure out how to begin. Any recommendations or tips?

Kudos!

Thanks, I have just been looking for information about this subject for a long time and yours is the best I’ve discovered till now. Howeverhttps://brazz.org/ , what in regards to the bottom line? Are you certain in regards to the supply?

I’m impressed, I need to say. Really rarely do I encounter a weblog that’s each educative and entertaining, and let me let you know, you’ve hit the nail on the head. Your concept is excellent; the difficulty is something that not sufficient persons are talking intelligently about. I’m very joyful that I stumbled throughout this in my seek for something regarding this.

Good day very nice site!! Guy .. Excellent .. Superb .. I’ll bookmark your blog and take the feeds also…I am glad to seek out numerous helpful information here within the publish, we need work out extra strategies in this regard, thanks for sharing.

Thank you for helping out, wonderful information. “The four stages of man are infancy, childhood, adolescence, and obsolescence.” by Bruce Barton.

The level of my appreciation for your work mirrors your own enthusiasm. Your sketch is visually appealing, and your authored material is impressive. Yet, you appear to be anxious about the possibility of moving in a direction that may cause unease. I agree that you’ll be able to address this matter efficiently.

Thanks I have just been looking for information about this subject for a long time and yours is the best Ive discovered till now However what in regards to the bottom line Are you certain in regards to the supply

I like this blog its a master peace ! Glad I detected this on google .

Wow! Thank you! I always needed to write on my blog something like that. Can I take a fragment of your post to my site?

Good day very cool website!! Man .. Beautiful .. Wonderful .. I’ll bookmark your site and take the feeds also…I’m glad to search out so many helpful info right here in the submit, we want work out extra techniques in this regard, thanks for sharing. . . . . .

I truly enjoy studying on this website , it contains fantastic blog posts. “Do what you fear, and the death of fear is certain.” by Anthony Robbins.

Hey There. I found your blog using msn. This is a really well written article. I will make sure to bookmark it and return to read more of your useful info. Thanks for the post. I’ll definitely comeback.

I am continually searching online for tips that can benefit me. Thx!

What Is FitSpresso? The effective weight management formula FitSpresso is designed to inherently support weight loss. It is made using a synergistic blend of ingredients chosen especially for their metabolism-boosting and fat-burning features.

My brother recommended I might like this

blog. He was totally right. This post truly made my day.

You can not imagine simply how much time I had spent for this information! Thanks!

There’s noticeably a bundle to learn about this. I assume you made sure good points in features also.

Great items from you, man. I’ve remember your stuff prior to and you are just extremely excellent. I actually like what you’ve acquired here, really like what you’re saying and the best way during which you say it. You’re making it entertaining and you continue to care for to keep it smart. I cant wait to read much more from you. That is actually a terrific website.

Hi, i think that i saw you visited my site so i came to “return the favor”.I am attempting to find things to improve my web site!I suppose its ok to use a few of your ideas!!

wonderful post.Never knew this, regards for letting me know.

I know this if off topic but I’m looking into starting my own blog and was curious what all is required to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very internet savvy so I’m not 100 positive. Any recommendations or advice would be greatly appreciated. Many thanks

Good write-up, I’m regular visitor of one’s web site, maintain up the excellent operate, and It’s going to be a regular visitor for a lengthy time.

This really answered my problem, thank you!

Nice blog right here! Also your site quite a bit up fast! What web host are you using? Can I am getting your associate hyperlink in your host? I wish my site loaded up as quickly as yours lol

What are Ageless Knees? Ageless Knees is a knee pain relieving program. Chris Ohocinski, a State-Licensed and Nationally Certified Athletic Trainer, came up with this program.

What Is LeanBiome? LeanBiome is a natural dietary supplement that promotes healthy weight loss.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

What i do not understood is in truth how you are not actually a lot more smartlyliked than you may be now You are very intelligent You realize therefore significantly in the case of this topic produced me individually imagine it from numerous numerous angles Its like men and women dont seem to be fascinated until it is one thing to do with Woman gaga Your own stuffs nice All the time care for it up

I have read some excellent stuff here Definitely value bookmarking for revisiting I wonder how much effort you put to make the sort of excellent informative website

Somebody essentially help to make significantly articles Id state This is the first time I frequented your web page and up to now I surprised with the research you made to make this actual post incredible Fantastic job

Hi there very cool web site!! Guy .. Beautiful .. Superb .. I’ll bookmark your site and take the feeds additionally…I’m glad to seek out numerous helpful information right here within the submit, we want work out more techniques in this regard, thank you for sharing. . . . . .

You really make it appear so easy along with your presentation however I find this matter to be actually something that I believe I would by no means understand. It kind of feels too complicated and extremely large for me. I’m having a look ahead to your subsequent post, I will try to get the dangle of it!

I really wanted to make a brief comment to be able to express gratitude to you for those great recommendations you are showing on this website. My prolonged internet investigation has finally been rewarded with reputable concept to go over with my good friends. I ‘d repeat that we site visitors are undoubtedly fortunate to dwell in a great community with so many wonderful individuals with valuable tricks. I feel really fortunate to have encountered the web pages and look forward to tons of more fun moments reading here. Thanks a lot again for a lot of things.

Hi, i read your blog occasionally and i own a similar one and

i was just wondering if you get a lot of spam comments?

If so how do you prevent it, any plugin or anything you can advise?

I get so much lately it’s driving me mad so any assistance is very much appreciated.

Somebody essentially lend a hand to make significantly posts I might state That is the very first time I frequented your web page and up to now I surprised with the research you made to create this particular put up amazing Excellent job

Hello my loved one I want to say that this post is amazing great written and include almost all significant infos I would like to look extra posts like this

I do believe all the ideas youve presented for your post They are really convincing and will certainly work Nonetheless the posts are too short for novices May just you please lengthen them a little from subsequent time Thanks for the post

There is visibly a lot to realize about this. I think you made certain good points in features also.